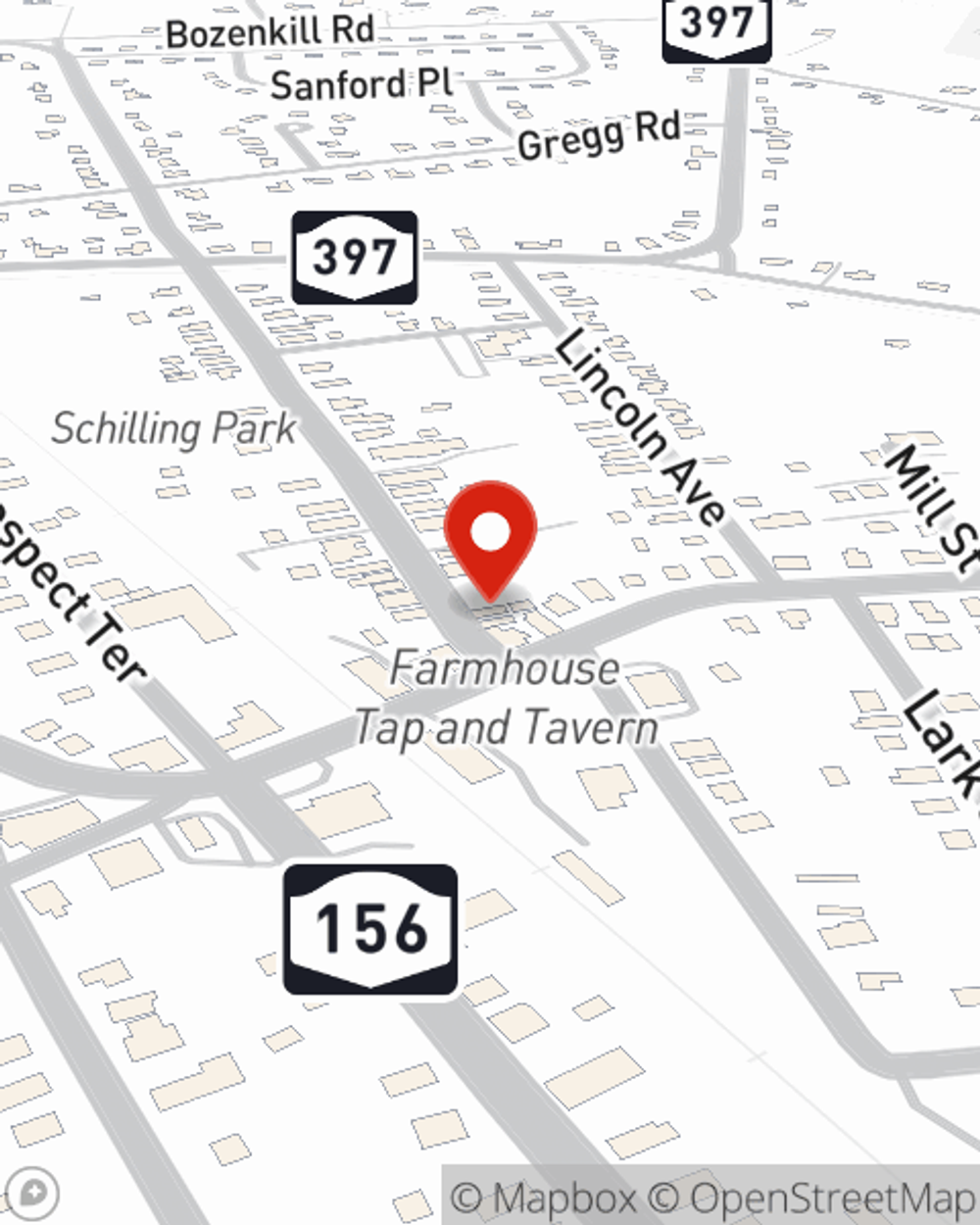

Business Insurance in and around Altamont

One of the top small business insurance companies in Altamont, and beyond.

Helping insure small businesses since 1935

- Altamont, NY

- Middleburgh

- Upstate New York

- Albany New York

- Cobleskill

- Schoharie

- New York State

- Schenectady

- Oneonta

- Guilderland

- Voorheesville

- Rotterdam

- Duanesburg

- Slingerlands

- Berne

- Colonie

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to keep track of. We understand. State Farm agent Lindsey Giagni is a business owner, too. Let Lindsey Giagni help you make sure that your business is properly covered. You won't regret it!

One of the top small business insurance companies in Altamont, and beyond.

Helping insure small businesses since 1935

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your salary, but also helps with regular payroll overhead. You can also include liability, which is vital coverage protecting your business in the event of a claim or judgment against you by a customer.

Contact State Farm agent Lindsey Giagni today to check out how a State Farm small business policy can safeguard your future here in Altamont, NY.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Lindsey Giagni

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.